Schwab Charitable Fund has entered into service agreements with certain affiliates of The Charles Schwab Corporation. Donate real estate collectibles vehicles computers and more.

Gst Implications On Csr Donations

We try to reflect the communities in which we operate.

. Gifts of vehicles. Giving through specialized charitable vehicles. We support and value diversity equity.

Donate car through Online Car Donation get. The car donation process is simple and fast. Become part of a community that shares your values and can amplify your impact.

At PECO we focus our corporate giving in four areas - building Exelons future workforce energy empowerment in our communities enrichment through local vitality and equal access to arts and culture. The IRS allows these deductions because they want to encourage charitable giving. In many instances youll get far less by donating your car than by selling or trading it in.

Donating vehicles If the claimed value of your donated vehicle is more than 500 in most cases your deduction is limited to the amount the car brings when its sold at auction. Free Vacation - Hotel or a Cruise. Fair Market Value Tax Break most cases.

The journey to grow your giving begins here whether you are an individual family business professional advisor or foundation. All car donations valued over 500 shall receive a fair market value. Knowing you made a difference.

By providing a tax-smart and simple giving solution to donors and their investment advisors. The IRS allows you to deduct only the charitys actual selling price and requires you to attach a statement of sale to the tax return. Schwab Charitable is an independent 501c3 public charity with a mission to increase charitable giving in the US.

Donate car online through our easy car donation form in under 2 minutes. TD Ameritrade Inc member FINRASIPC a subsidiary of The Charles Schwab. We have created a network of donation websites to help those looking to help others.

While gifts of cash or appreciated investments can be given directly to a charity it often makes sense to consider specialized charitable vehicles to make giving easier and to manage the tax benefits. Advise clients across generations and help them establish their charitable legacies through donor-advised funds and other charitable vehicles. Free Towing.

The charity has 30 days after it sells your vehicle to issue you a. With Causes Charitable network recognizes the needs of others both great and small. Impactful Giving Made Easy Our Advance Change Funds -donor advised funds- enable agile and efficient giving for individual donors and institutions.

Schwab Charitable is the name used for the combined programs and services of Schwab Charitable Fund an independent nonprofit organization.

What Are The Different Types Of Charitable Vehicles Foundation Source

Donating A Car To Charity You Might Want To Pump The Brakes

Operating For Impact Choosing A Giving Vehicle Rockefeller Philanthropy Advisors

2022 Car Donation Tax Deduction Information

Donate Your Unwanted Vehicle Running Or Not To Help Our Charities Unwanted Charity Donate

Vehicles For Charitable Giving Fidelity

Charitable Deductions On Your Tax Return Cash And Gifts

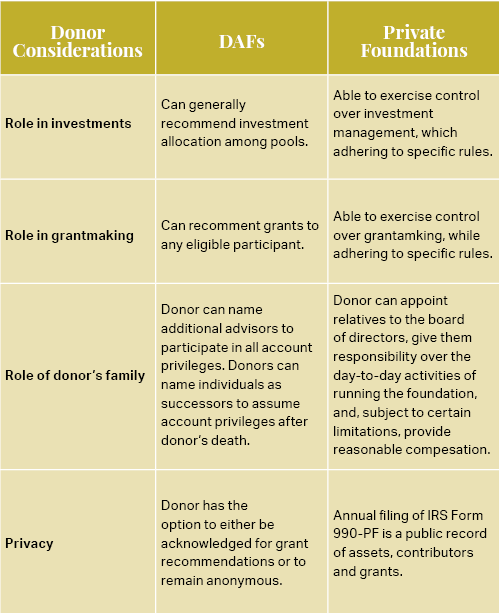

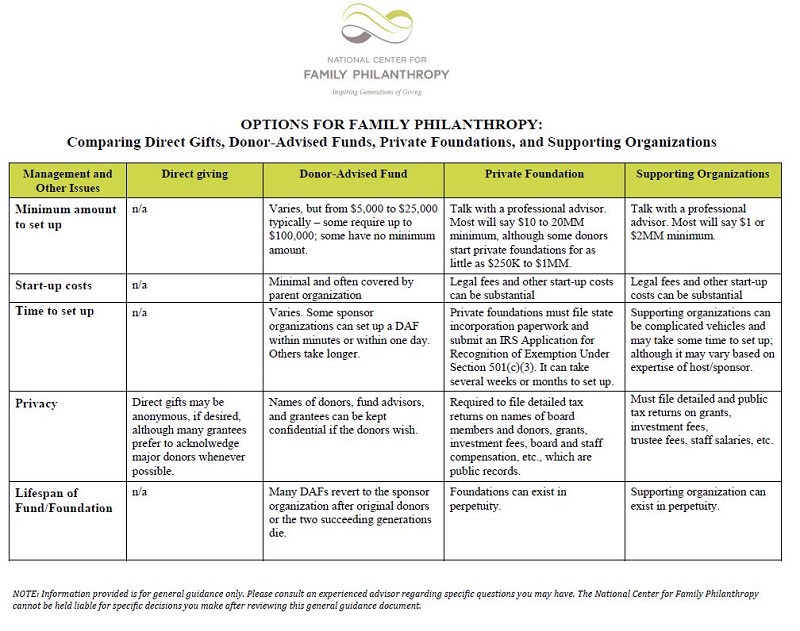

How Do Donor Advised Funds Compare With Private Foundations And Other Family Giving Vehicles Ncfp